State & National Resources for Businesses

What are you looking for?

View our Business How To for more information:

There are a number of master lists of funding programs for small businesses that are being continuously updated, including:

-

CO – US Chamber of Commerce Small Business Guide – a comprehensive resource listing, plus business survival tips, from the US Chamber of Commerce.

-

SCORE – COVID-19 Response Guide – a comprehensive guide to everything from funding sources to managing your business through crisis.

-

Forbes Business Resources List – focuses on available resources for small businesses.

-

Alabama Department of Commerce – guide for employers navigating coronavirus responses.

-

Atlas Alabama – resources at the federal, state, and local levels specifically for small business owners.

We’ve picked the most relevant programs from these lists and included them below for your reference.

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

$200M Revive Plus program to support small businesses

What It Is: Gov. Kay Ivey today announced Revive Plus, a $200 million grant program to support small businesses, nonprofits and faith-based organizations in Alabama that have been affected by COVID-19.

Revive Plus is the second wave of funding for these organizations with 50 or fewer employees and will award grants of up to $20,000 for expenses they have incurred due to operational interruptions caused by the pandemic and related business closures.

Who It’s For: Small businesses, non-profits and faith-based organizations

SBA Paycheck Protection Program Loans (lesser of $10 million or 2.5x average monthly payroll)

-

What It Is: Partially forgivable 1% interest low-interest loans (with a 2 year maturity).

-

Who It’s For: Small businesses and nonprofits

-

How It Works: SBA is making forgivable loans available through its existing network of 7(a) lenders. A portion of these loans – which cannot exceed 2.5x your average monthly payroll or $10 million, whichever is less – become forgivable if you keep your existing payroll in place for an 8 week period. If you do, you will not have to pay back any of the loan you used for payroll (and a small portion you used for mortgages, rent payments, leases, and utility service agreements) during that 8 week period. This effectively means that the loan acts like a cash grant – as long as you can keep your employees on payroll during the next eight weeks.

For More Information / To Apply:

-

Read ASBDC’s CARES Act Relief page.

-

Start gathering the materials you will need to apply.

-

Contact a participating lender and fill out a sample application.

-

Read the Alabama Small Business Development Center Summary or the Economic Innovation Group’s PPP Summary. We’ll provide application information and a 7(a) lender list as soon as the program becomes available.

SBA Express Bridge Loan Pilot Program (up to $25,000)

-

What It Is: Short-term bridge financing while Economic Injury Disaster Loan comes into place

-

Who It’s For: Small businesses and nonprofits

-

How It Works: This facility allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork. These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing and can be a term loans or used to bridge the gap while applying for a direct SBA Economic Injury Disaster loan. If a small business has an urgent need for cash while waiting for decision and disbursement on Economic Injury Disaster Loan, they may qualify for an SBA Express Disaster Bridge Loan.

For More Info: Contact your local SBA District Office.

SBA Economic Injury Disaster Loan Program (up to $2 million)

-

What It Is: Loans direct from SBA at 3.75% (Or 2.75% for nonprofits), with a possible $10,000 advance.

-

Who It’s For: Small businesses and nonprofits

-

How It Works: The US Small Business Administration’s (SBA) EIDL Program is designed for businesses impacted by disasters, including businesses impacted by COVID-19 in Alabama– an EIDL can help you meet necessary financial obligations that your business or private, non-profit organization could have met had the disaster not occurred.

For More Info / Apply Online: Use SBA’s Disaster Loan Assistance website. If you need help with your application, contact ASBDC. If you have technical issues, please call 1-800-659-2955 or email DisasterCustomerService@sba.gov.

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

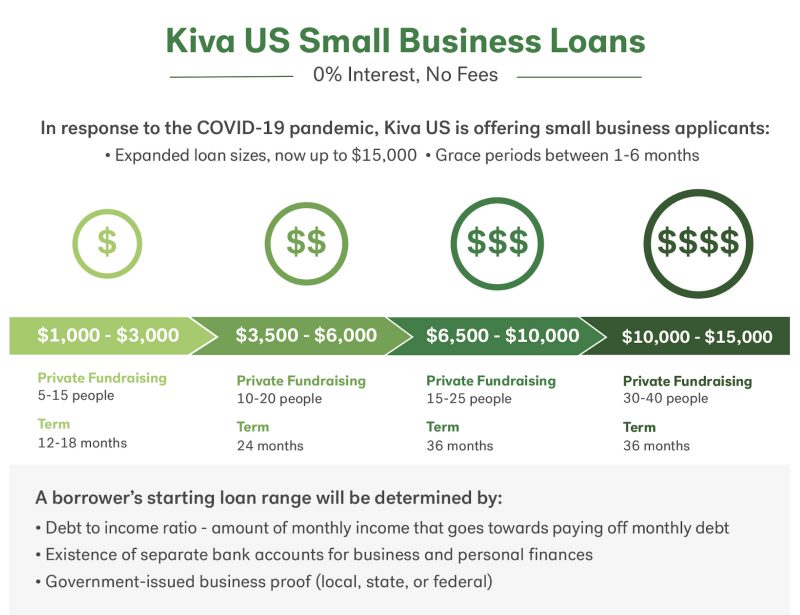

KIVA Crowdsourced Loans ($0 – $15,000)

-

What It Is: Crowdsourced loans at 0% interest with no fees

-

Who It’s For: Small businesses and nonprofits

-

How It Works: Refer to image on the right

For More Information / How To Apply: visit kiva.org/borrow.

WeFunder Emergency Crowdsourced Loans ($20,000 – $1 million)

-

What It Is: Crowdsourced loans at 0% interest (for one year), with revenue share thereafter.

-

Who’s It For: Small businesses

-

How It Works: Under WeFunder’s model, companies list themselves on an online funding portal and encourage their customers–and other WeFunder investors–to pool capital to make you a loan. Instead of fixed principal and interest payments, WeFunder allows borrowers to totally forgo payments during the first year, then pay a percentage of revenue you make (rather than some fixed amount) back to those who made you the loan after that.

For More Information / How To Apply: https://wefunder.com/war-on-virus

Mainvest Main Street Crowdsourced Loans (varies)

-

What It Is: Immediate $2,000, 0% interest 120-day loan, followed by a revenue share agreement for additional amounts

-

Who It’s For: Small businesses

-

How it Works: If you register for Mainvest (a crowdfunding platform) and launch a capital campaign, you may be eligible for an immediate $2,000, 0% interest advance. You’ll need to launch a capital campaign and attract funders to get this advance, and they’ll be paid a portion of your revenues once you get through the crisis.

For More Information / How To Apply: https://mainvest.com/main-street-initiative

GoFundMe Small Business Grants (no minimum or maximum)

-

What It Is: Donation platform for loyal customers to give to affected businesses

-

Who It’s For: Small Businesses

-

How It Works: A small business either creates or claims a donation campaign someone already started for them, and then pushes it out across social media to get as many patrons as possible to donate. Proceeds can be used for anything from paying overhead to keeping employees on payroll.

For More Info / Create or Claim a Campaign: https://www.gofundme.com/small-business-relief-fundraisers

Facebook Small Business Grants (amounts TBD)

-

What It Is: $100 million international funding commitment for small business grants

-

Who It’s For: Small Businesses (in 30 countries)

-

How It Works: Facebook has yet to determine how they’ll use the grant or how to apply, but suggest that some potential uses are: (1) Keep your workforce going strong, (2) Help with your rent costs, (3) Connect with more customers, and (4) Cover operational costs. You can register on their page for updates as they become available.

For More Info / Register for Updates: https://www.facebook.com/business/boost/grant

MusiCares (up to $1,000)

-

What It Is: Grants to replace income from cancelled events

-

Who It’s For: Musicians

-

How It Works: Apply through the link below – funds will be distributed on a first come, first served basis based on proof of loss.

For More Info: https://www.grammy.com/musicares/get-help/covid-19-relief-fund-faq

We have inquiries out to all major statewide foundations, including Regions, Alabama Power, Protective, and others, to ask whether they would like to receive COVID grant requests at this time. If so, we will list those applications and priorities here.

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

Alabama Department of Labor (State Benefit – Unemployment Claims)

-

Who It’s For: All Employers

-

What It Does: All charges will be waived against those employers who file partial unemployment compensation claims on behalf of their employees. These charges will be waived until further notice. ADOL is encouraging all employers who can file on their employees’ behalf to do so. This waiver means that employers’ experience ratings will NOT be affected by COVID-19 related claims.

Federal Payroll Tax Credits for Providing Employee Benefits (Federal Benefit – Employee Leave)

-

Who It’s For: Employers with 500 employees or less

-

What It Does: Provides immediate access to cash (through 100% refundable payroll tax credits) for businesses with fewer than 500 employees to cover:

-

Two weeks of paid sick leave for employees who have been quarantined, have a sick family member or have been affected by school closings.

-

Up to 3 months of paid family and medical leave amounting to no less than two-thirds of regular pay for those employees listed above.

-

Employers with fewer than 50 employees are eligible for an exemption from the requirements to provide leave to care for a child whose school is closed, or child care is unavailable in cases where the viability of the business is threatened.

-

For More Information / How to Claim: Visit https://www.irs.gov/newsroom/treasury-irs-and-labor-announce-plan-to-implement-coronavirus-related-paid-leave-for-workers-and-tax-credits-for-small-and-midsize-businesses-to-swiftly-recover-the-cost-of-providing-coronavirus.

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

There are a number of sites that allow retailers to sell gift cards to their customers. They include:

-

-

This site has the broadest statewide and national coverage and covers all types of retail.

-

-

-

This site offers restaurant-focused gift cards offered at discounts (at the owner’s election).

-

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

There are a number of free programs that offer assistance to businesses that need help with business models, HR issues, assistance with loan and grant applications, and dozens of other issues that have arisen because of COVID-19.

-

The Alabama Small Business Development Center has provided Guidance for Businesses and Employers to Plan and Respond to Coronavirus Disease 2019 (COVID-19). They also offer free business coaching and loan application assistance. Contact ASBDC today to find out more.

-

SCORE is a national organization that offers free mentoring and business planning workshops. It also maintains a comprehensive guide for financing and running your business in times of crisis.

-

MicroMentor connects you with mentors in various areas of business if you are concerned with keeping your business running over the next few months amid COVID-19.

-

US Chamber of Commerce Resilience in a Box: Assess your business’ capabilities and areas of weakness.

-

Deloitte has developed in-depth analysis around business resiliency and continuity of operations.

-

McKinsey has put together this guide for businesses to assess COVID19’s impact on their business

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

There are a number of free programs that offer assistance to businesses that need help with business models, HR issues, assistance with loan and grant applications, and dozens of other issues that have arisen because of COVID-19.

-

The Alabama Small Business Development Center has provided Guidance for Businesses and Employers to Plan and Respond to Coronavirus Disease 2019 (COVID-19). They also offer free business coaching and loan application assistance. Contact ASBDC today to find out more.

-

SCORE is a national organization that offers free mentoring and business planning workshops. It also maintains a comprehensive guide for financing and running your business in times of crisis.

-

MicroMentor connects you with mentors in various areas of business if you are concerned with keeping your business running over the next few months amid COVID-19.

-

Gener8tor is hosting emergency one-week virtual programs for small businesses affected by the COVID-19 outbreak. Sign up for a program here.

-

US Chamber of Commerce Resilience in a Box: Assess your business’ capabilities and areas of weakness.

-

Deloitte has developed in-depth analysis around business resiliency and continuity of operations.

-

McKinsey has put together this guide for businesses to assess COVID19’s impact on their business

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!

Center for Disease Control: Coronavirus Guidance. The Center for Disease Control has produced guidance for companies to best respond to the COVID-19 virus. Major topics include:

-

Preparing Workplaces for a COVID-19 Outbreak

-

Reducing Transmission Among Employees

-

Maintaining Healthy Business Operations

-

Maintaining a Healthy Work Environment

Alabama Department of Public Health. The Alabama Department of labor is a comprehensive COVID-19 resource for the state. Major topics include COVID-19 Related Emergency Actions of Alabama State Agencies and Resources for Patients.

Alabama Department of Labor: Coronavirus Guidance. The Alabama Department of Labor has produced guidance for companies to best respond to the COVID-19 virus. Major topics include news releases, weekly initial unemployment claims, information about coronavirus and unemployment insurance benefits, and more.

Alabama’s COVID-19 Data and Surveillance Dashboard. Track confirmed COVID-19 cases and find test sites throughout the state.

HudsonAlpha Institute for Biotechnology. Get updates on HudsonAlpha’s response to COVID-19 and more information such as the genetics of coronavirus.

Do you have a program or know of an initiative not listed above that could be helpful? Please let us know!